02083433523

Our Accountancy Services

Explore our tailored services for all types of businesses and organisations.

Company's Accounts and Financial Reporting

Financial Statements Preparation Cash Flow Projections Profit and Loss Statements Balance Sheet Analysis Financial Forecasting

Bookkeeping

Financial Record Keeping Payroll Services General Ledger Maintenance Accounts Payable and Receivable Management Bank Reconciliation

Tax Compliance Assistance

Corporate Tax Returns Personal Income Tax Planning Sales Tax Compliance Tax Consultancy Transfer Pricing VAT and GST Services International Taxation

Capital Gains Tax (CGT)

Inheritance Tax (IHT)

Corporation Tax

Financial Record Keeping Corporate Tax Returns

General Ledger Maintenance Accounts Payable and Receivable Management Bank Reconciliation

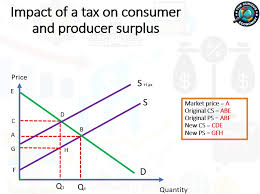

Indirect Tax

An indirect tax is a consumption tax levied on goods and services, which is collected by an intermediary (such as a retailer or manufacturer) from the consumer at the point of sale and then paid to the government. The consumer ultimately bears the economic burden of the tax, though they do not pay it directly to the tax authority. indirect taxes include:

Value Added Tax (VAT): Common in the UK and European Union. The standard UK VAT rate is 20%.

Excise Duties: Specific taxes on particular goods such as alcohol, tobacco, fuel, and sugary drinks.

Customs/Import Duties: Levies imposed on goods imported from other countries to bring their costs in line with domestically produced goods.

Environmental Taxes: Such as the Aggregates Levy or Landfill Tax, designed to discourage environmentally harmful activities.

Management Consultancy

Financial Planning and Budgeting Business Process Optimization Risk Management Corporate Governance Mergers and Acquisitions Consultancy Business Restructuring

Financial Advisory Services

Investment Planning and Strategy Wealth Management Retirement Planning Mergers and Acquisitions Advisory Business Valuation Debt Restructuring

Corporate Finance and Capital Raising

Business Loan Advice Debt Financing Equity Financing Capital Structure Optimization Initial Public Offerings (IPO) Advisory

Forensic Services

Company Secretarial Services

Filing of Annual Returns Preparation of Company Resolutions Corporate Record Maintenance Regulatory Compliance Reporting Shareholder Communication

Outsourced Accounting Services

Complete Outsourced Accounting Solutions Virtual CFO Services Financial Analysis and Reporting Accounting System Implementation

Small Business Accounting and Support

Business Formation and Structure Small Business Tax Filing Accounting System Setup

Non-Profit and NGO Accounting

NGO Financial Management Non-profit Audits Donor Reporting

Why Choose Us?

Discover the compelling reasons to partner with Multiple Choice Accountancy.

Expertise You Can Trust

Our experienced team delivers top-notch accountancy solutions tailored for your needs.

Ability to Handle Complex Financial Transactions

Affordable Pricing

We offer professional services without hidden costs, ensuring great value.

Comprehensive Services

From sole traders to charities, we cover all of your accountancy requirements.

Regulatory Compliance Support

Stay compliant with HMRC, Companies House and Charity Commission regulations effortlessly.